Cyclical Variations

The term “cyclical variation” refers to the recurrent variation in a time series that usually lasts for two or more years and are regular neither in amplitude nor in length.

In the words of Lincoln L Chao, “Up and down movements which are different from seasonal fluctuations in that they extend over longer period of time usually two or more years.”

These variations are otherwise known as oscillating movements which take place due to ups and downs recurring after a period of greater than one year. These variations, though more or less regular are not necessarily, uniformly periodic. This means that they may not follow exactly similar pattern after equal intervals of time say 7 to 9 years. They may not, always complete two years with a fixed duration of time.

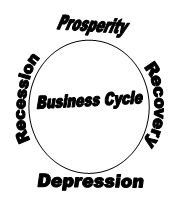

In the field of economics and business, they follow a well determined pattern with four different phases, viz: (i) prosperity phase, as we know, businesses prosper, prices go up, and profits are multiplied. This causes over-development, difficulties in transportation, increase in wage rate, deficiency in labour, high rate of interest, dearth of money in the market and price concession etc. leading to depression (slump). In the depression phase, as we know, there is pessimism in trade and industries, factories close down, businesses fail, unemployment spreads, the rate of wages and prices are low. This causes idleness of money, availability of money at low interest, increase in demand for goods of money at low interest, increase in demand for goods and services characterised by the situation of recovery which ultimately leads to prosperity, or boom.

The adjecent diagram illustrates the different phases of business cycle described above.

A business cycle shown as here may complete in 3 years, 5 years, 7 years or 9 years. Most of the business series relating to price, income, investment, wage, production etc. reveal this type of cycle.