A risk-Return Trade-off

A risk-Return Trade-off

A firm should decide whether or not it should use short-term financing. If short-term financing has to be used, the firm must determine its portion in total financing. This decision of the firm will be guided by the risk-return trade off Short-term financing may be preferred over long-term financing for two reasons: (i) the Cost advantage and (ii) flexibility. But short-term financing is more risky than long-term financing.

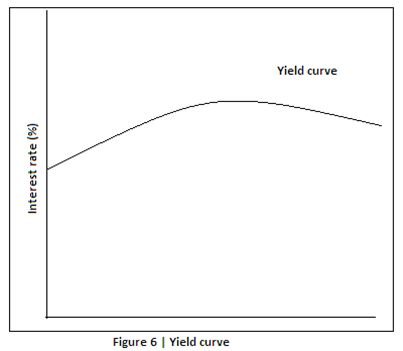

Cost: Short-term financing should generally be less costly than long-term financing. It has been found in developed countries, like USA, that the rate of interest is related to the maturity of debt. The relationship between the maturity of debt and its cost is called the term structure of interest rates. The curve, relating to the maturity of debt and interest rates, is called the Yield curve. The yield curve may assume any shape, but it is generally upward sloping. Figure shows the yield curve. The figure indicates that more the maturity greater the interest rate.

As discussed earlier in this book, the justification for the higher cost of long-term financing can be found in the liquidity preference theory. This theory says that since lenders are risk averse, and risk generally increases with the length of lending time (because it is more difficult to forecast the more distant future), most lenders would prefer to make short-term loans. The only way to induce these lenders to lend for longer periods is to offer them higher rates of interest.

The cost of financing has an impact on the firm’s return. Both short and long-term financing have a leveraging effect on shareholders’ return. But the short-term financing ought to cost less than the long-term financing; therefore, it gives relatively higher return to shareholders.

It is noticeable that in India short-term loans cost more than long-term loans. Banks are the major suppliers of the working capital finance in India. Their rates of interest on working capital finance are quite high. The main source of long-term loans are financial institutions which till recently were not charging interest at differential rates. The prime rate of interest charged by financial institutions is lower than the rate charged by banks. Flexibility It is relatively easy to refund short-term funds when the need for funds diminishes. Long-term funds when the need for funds diminishes. Long-term funds such as debenture loan or preference capital cannot be refunded before time. Thus, if a firm anticipates that its requirements for funds will diminish in near future, it would choose short-term funds.

Risk Although short-term financing may involve less cost, it is more risky than long-term financing. If the firm uses short-term financing to finance its current assets. it runs the risk of renewing borrowings again and again. This is particularly so in the case of permanent assets. As discussed earlier, permanent current assets which a firm should always maintain. If the firm finances its permanent current assets with short-term debt. it will have to raise new short-term funds as debt matures. This continued financing exposes the firm to certain risks. It may be difficult for the firm to borrow during stringent credit periods. At times, the firm may be unable to raise any funds and consequently. Its operating activities may have to borrow at most inconvenient terms. These problems are much less when the firm finances with long-term funds. There is less risk of failure when the long-term financing is used.

Risk-return-off Thus, there is a conflict between long-term and short-term financing Short-term financing is less expensive than long-term financing. but, at the same time, short-term financing involves greater risk than long-term financing. involves a trade-off between risk and return. This trade-off may be further explained with the help of an example.