Financial Management

Financial Management

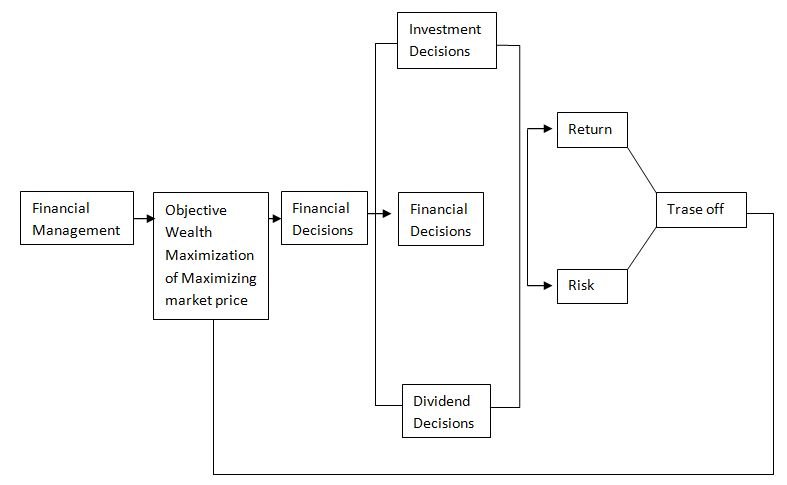

Financial management involves the solution of the three decisions of the firm. These three decisions are investment decisions, financing decisions and dividend decisions. These three decisions determine the value of the firm to its shareholders. The firm should strive for an optimal combination of the three decisions which maximize the shareholders wealth. Because these are interrelated. They should be solved jointly.

These decisions affect the firm’s value through their impact on return-risk character. Almost all financial decisions involve some sort of risk-return trade off. The more risk the firm is willing to assume, the higher the expected return from a given course of action, For example, in the area of working capital management, the less inventory held in hand, the higher the expected return (since less of the firm’s asset are involved in non-income producing functions) but also the greater risk of running out of stock. Similarly, in the other decisions i.e., management of long term assets and financial structure. A manager has to access the risk return trade off available and incorporating this into wealth maximization frame work. This character, in turn, determines, the value that investors hold regarding returns on their investments. Because these returns are not known with certainty, risk is involved. Financial manager has to strive a balance in risk return. Theoretically, the most appropriate and most efficient way to consider the joint effect of three decisions is through stock valuation model. It can be represented mathematically.

V=f ( I. F. D) = G (r, o)

Where – V = Value of the firm

I = Investment decision

F= Finacing decision

D= Devidend decision

r= Expected returns of share holders

o= Standard deviation of expected return

In Order to maximize share price we would very I, F and D jointly to maximise V through r and o. In this equation it is important to recognize that a firm does not influence share price directly through investments financing and dividend policies, Rather share price is determined by the investors who use information. with respect to these policies to determine the risk return character of the firm in and out of the firm should be constantly mointered to assure safety and proper utilisation of funds.