Net Income Approach

Net Income Approach

The N1 approach suggested that the firm can increase its market value of lower its cost of capital by increasing the proportion of debt in the capital structure. The crucial assumptions of this approach are:

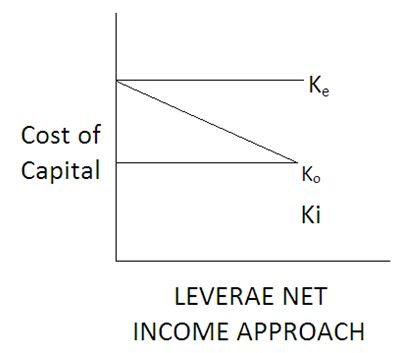

- The use of debt does not change the risk complexion as a result the equity capitalization rate (Ke) and debt capitalization rate K1 remains constant with change in leverage.

- The debt capitalization rate is less than equity capitalization rate i.e., Ke > K1.

- The corporate tax does not exist.

As we know5

K0 = K0 – (Ke – K1) D/V

Where K0 is overall cost of capital, D is market value of debt and V is the market value of all the securities. As per the assumptions K0 and K1 are constant, equation I state that will decrease with leverage (D/V). If financial leverage is zero, then K0 will be equal to Ke and Kv will approach to K1 when leverage approaches one. According to N1 approach there exists an optimum capital structure, where is minimum. Graphically it can be represented as follows: