Net Operating Income Approach

Net Operating Income Approach

The Net approach suggest that the market value of the firm is not affected by the capital structure changes and overall cost of capital remains constant like NI approach, it is also based upon certain assumptions which are :

- The market capitalizes the value of the firms as a whole. Thus, the split between debt and equity is not important.

- The debt capitalization race (K0) remains constant and there is no corporate tax.

As we know,”

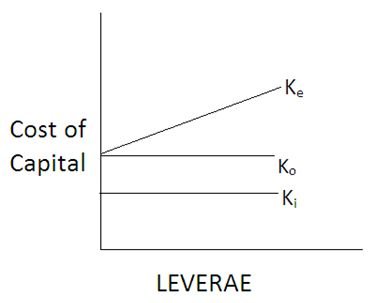

Ke = Ko + (Ko + Ki) D/E

Where D/E is the debt-equity ratio at market price. The equation 2 states that if Ko and ki are constant, then Ke will rise linearly with leverage. Thus there is no single point or range where the capital structure is optimum. Graphically, it can be represented as follows:

Fig. 2. Net operating Income Approach

Under the NOI approach when low cost debt is introduced in the capital structure, its advantages is exactly offset by the increased cost of equity in such a way that the resultant cost of capital remains same. Hence, there is no optimum capital remains same. Hence, there is no optimum capital structure or cost of capital is not a function of leverage.