Consumption Demand

The consumer goods and services demanded by the households constitute the consumption demand. In this regard, Keynes propounded a law known as the ‘Fundamental Psychological Law of Consumption.’ According to Keynes, consumption depends on personal disposable income and as income rises, consumption also rises but not as much as the increases in income. That means a part of the increase in income is saved. In other words, Marginal propensity to Consume (MPC) is always less than one. Symbolically we can write MPC = That means what amount of increase in income is devoted to increase in consumption is called MPC. But what amount of a given income is devoted to consumption is called Average Propensity to Consume (APC). Symbolically APC=. This relation between income and consumption is called consumption function. Symbolically, consumption function can be written as follows:

C = f (Y)

Where, C = Consumption

Y = Income

F = Functional relationship

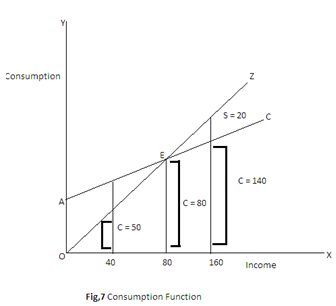

Since consumption is a direct function of income, aggregate consumption is also a direct function of aggregate income. That means as aggregate income rises, aggregate consumption also rises but less than proportionately. Plotted on a piece of graph paper, aggregate consumption curve becomes upward sloping as illustrated below.

The consumer goods and services demanded by the households constitute the consumption demand. In this regard, Keynes propounded a law known as the ‘Fundamental Psychological Law of Consumption.’ According to Keynes, consumption depends on personal disposable income and as income rises, consumption also rises but not as much as the increases in income. That means a part of the increase in income is saved. In other words, Marginal propensity to Consume (MPC) is always less than one. Symbolically we can write MPC = That means what amount of increase in income is devoted to increase in consumption is called MPC. But what amount of a given income is devoted to consumption is called Average Propensity to Consume (APC). Symbolically APC=. This relation between income and consumption is called consumption function. Symbolically, consumption function can be written as follows:

C = f (Y)

Where, C = Consumption

Y = Income

F = Functional relationship

Since consumption is a direct function of income, aggregate consumption is also a direct function of aggregate income. That means as aggregate income rises, aggregate consumption also rises but less than proportionately. Plotted on a piece of graph paper, aggregate consumption curve becomes upward sloping as illustrated below.

In the above diagram, the consumption function is represented by the upward sloping curve (c) starting from the point ‘A’ on Y-axis. This indicates that as income increases in X-axis, consumption also increases in ‘Y-axis’. But when income is zero, consumption is not equal to zero. It is positive and is market by OA in the diagram. This is called autonomous consumption, I.e. consumption independent of income. At point E, consumption is equal to income. This is called break-even level of income and APC = 1. Before the break-even level of income, when income is 40, consumption is higher that income and is equal to 50. Here the APC > 1( ). After the break-even level of income, when income is 160, consumption is lower than income and is equal to 140 and saving is 20. Here APC < ( ) This shows that as income rises, consumption also rises but not as much as the rise income. In other words, at higher level of income, the gap between income and consumption becomes wider and wider. If a higher level of income is to be sustained, this gap must be filled up by an equal amount of investment. This is the implications of Keynesian consumption function in the theory of income determination.

Keynes assumed consumption function to be stable in the short-run because consumption is conditioned by the behaviour pattern and is a matter of habits. Habits do not change quickly in the short-run. Therefore when income increases, consumption pattern cannot change pari pasu with the change in income. Income that decision is taken, the increased income is likely to be devoted to savings. Keynes just stated that only a part of the increased income will be devoted to consumption. Similarly when income falls, consumption cannot fall by the same degree. This is due to the fact that consumers cannot change their consumption habits immediately because of fall in income.